High Return Rate Processing Fee Update for Amazon Sellers

Table of Contents

Amazon has announced some changes to the returns processing fee, which is expected to impact sellers on the platform who experience high return rates.

The Updated Amazon Return Rate Processing Fee

Starting June 1st, 2024, the existing updated returns processing fee is scheduled to go into effect for products that experience high return rates—except apparel and shoes.

Originally announced as part of the 2024 US fee changes, these changes are expected to occur after the close of every three months. For instance, returns of units shipped in June will be charged in the following September.

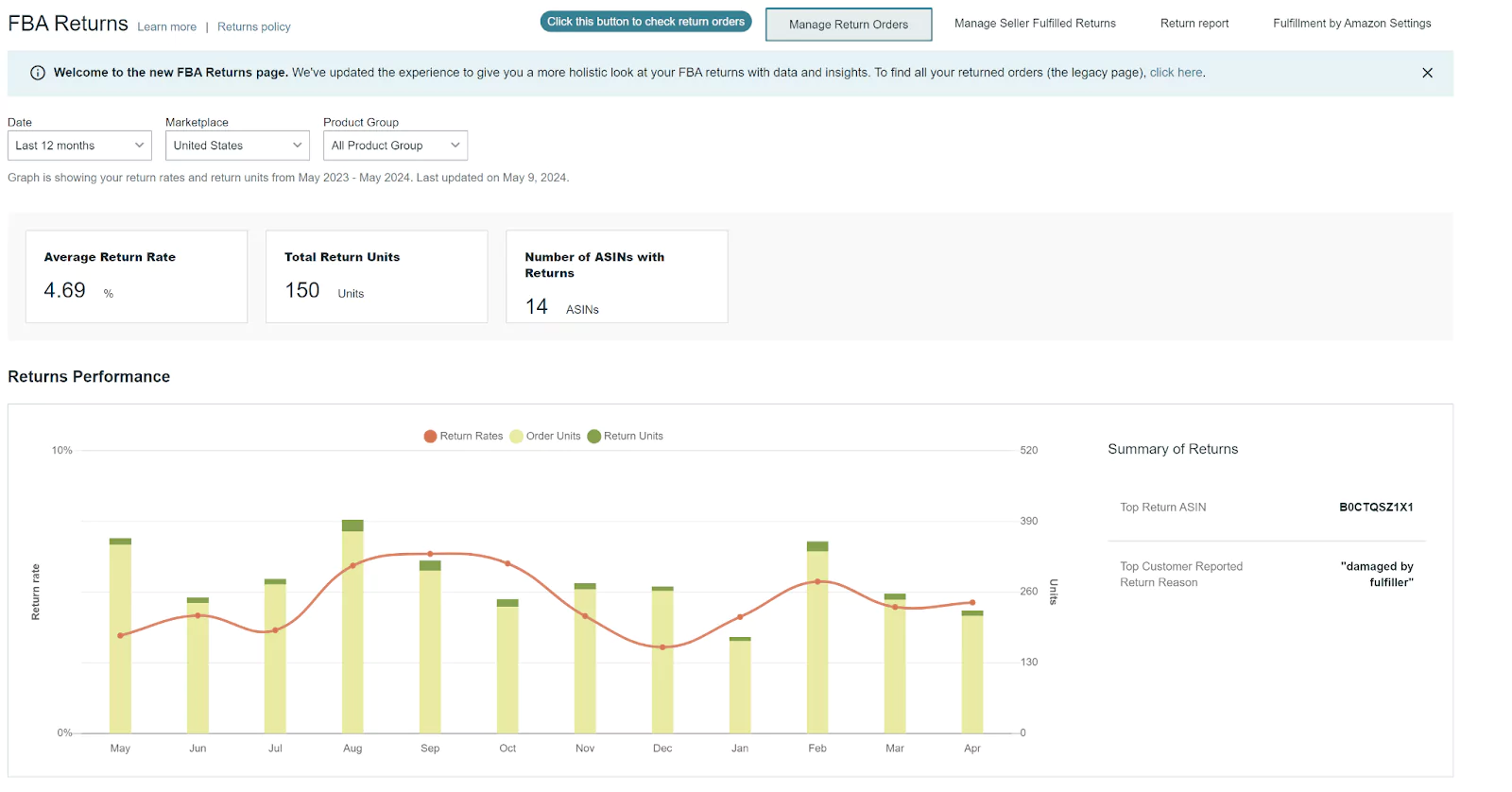

In order to better understand both the returns and return rates, while also identifying actions new and old Amazon sellers can take to limit the risk of incurring these unfortunate fees, Amazon has made the following improvements to the Return Insights Dashboard (located on the FBA Returns page):

- Number of returned units and return rate percentages used to calculate the fee

- Minimum return rate thresholds above which fees are charged

- Number of returned units above the threshold for which fees are charged

To access the Return Insights dashboard, go to the FBA Returns page.

The updated returns processing fee looks at product returns across three months starting with the month the product shipped and ending two calendar months later. For example, for products shipped in June, returns will be tracked through June, July, and August. The fee will only be charged if the total number of returns for the products shipped in that month exceeds the threshold set for the specific product’s fee category, which is now published on the Returns processing fee page. If the returns threshold is exceeded, the returns fee will apply to each returned unit above the threshold.

For products that ship less than 25 units in a month, the updated returns processing fee is not applied for that month. Additionally, for products enrolled in the New Selection Program, Amazon will waive the fee for the first 20 returned units that exceed the return rate threshold.

For detailed information on fee structure and rates, return rates calculation, thresholds, and exemptions, go to 2024 returns processing fee changes.

Conclusion

The updated returns processing fee on Amazon is a great reminder to minimize—when possible—your product returns. By using the new Returns Insight dashboard—or our Inventory Management tool that notifies you of any potential quality issues—you can look at incredibly valuable data that will allow you to easily identify products with high return rates and take appropriate actions to reduce the damage to your e-commerce business.

Also, remember to carefully and proactively manage your returns to avoid these processing fees where possible. In addition to saving you money, you’ll also improve your brand’s overall profitability on the Amazon marketplace.

Frequently Asked Questions

Achieve More Results in Less Time

Accelerate the Growth of Your Business, Brand or Agency

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.