Market Tracker 360: A Bird’s Eye View of the Catalyst to Smarter Selling

Table of Contents

- Refining and Catering A Created Market to a Sub Niche

- Market View

- Upon Filtering To Segment Out Our Market of Interest

One thing I have always believed with conviction is that Helium 10 stands out.

It does not come from a place of bias, but rather a place of experience and continuous observation.

Time and time again, through the lens of my esteemed colleagues and those of you reading this with who I have had the pleasure of interacting, I have seen and heard about our ability to listen, implement and innovate. We are constantly listening to what you have to say and do our best to upgrade our tools quickly to fit your evolving needs.

Last year that is exactly how our Bigger.Better.Launch! webinars came to be.

Every month in 2022, we hosted an hour-long webinar where we showcased cutting-edge product updates, innovative strategies, and the latest trends from the most prominent players in the market – Amazon and Walmart to help high-growth sellers navigate the ever-evolving e-commerce landscape.

In November of last year, we started a new segment to help you learn how Market Tracker 360 works.

Market Tracker 360 is our competitive insights tool on steroids for our 6, 7, and 8+ figure sellers meant to provide users with valuable insights and data on Amazon marketplace trends whether that be at the brand, product, or category levels.

The tool can help you do all sorts of things like track and monitor your competitors, research product trends, identify hot products to capitalize on, and make data-driven decisions by giving you actionable data about your Amazon business, such as adjusting your pricing strategy, product offerings or exploring new markets.

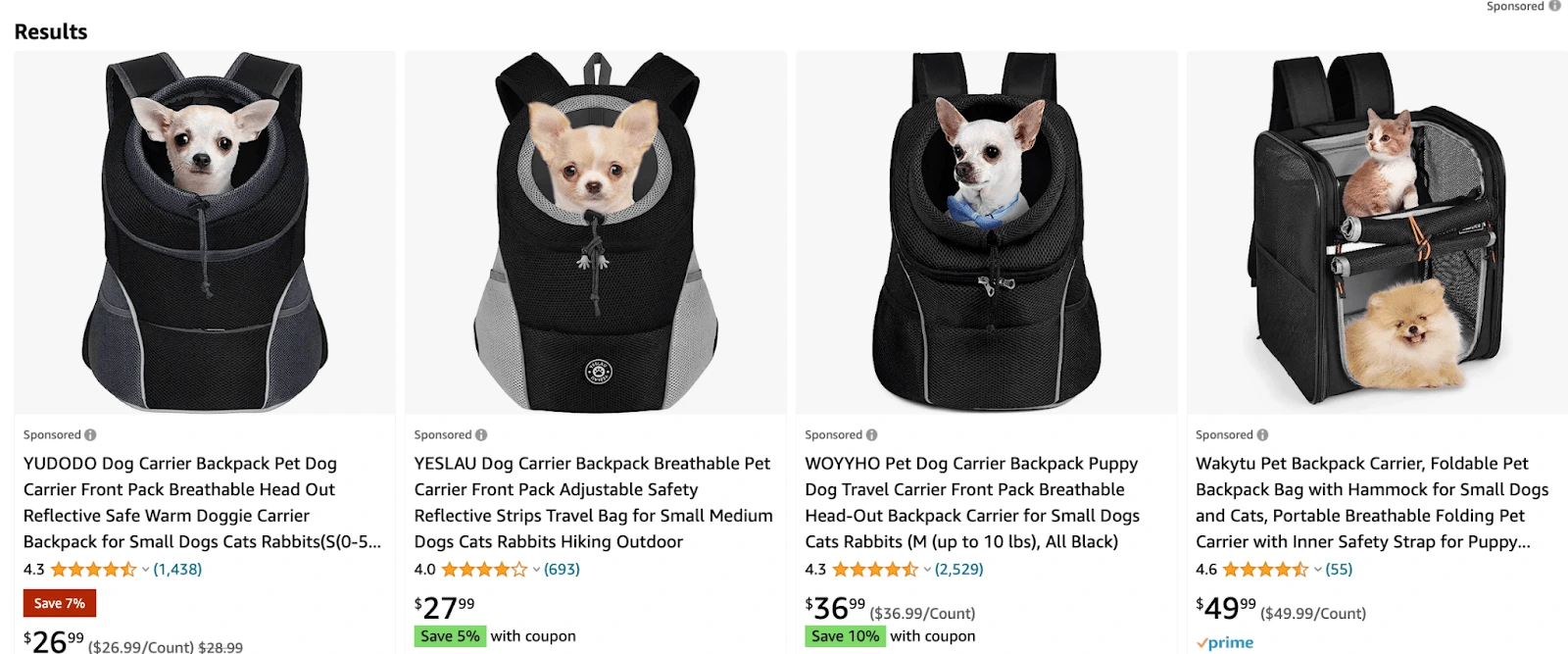

Back when we were just starting the segment, we took an in-depth look at the Christmas Tree Markets. However, in January, I went into Blackbox, inputted a few parameters alongside the Pets category, and found a Summer Dog Backpacks niche. Now, I do not have pets myself but check this out.

Refining and Catering A Created Market to a Sub Niche

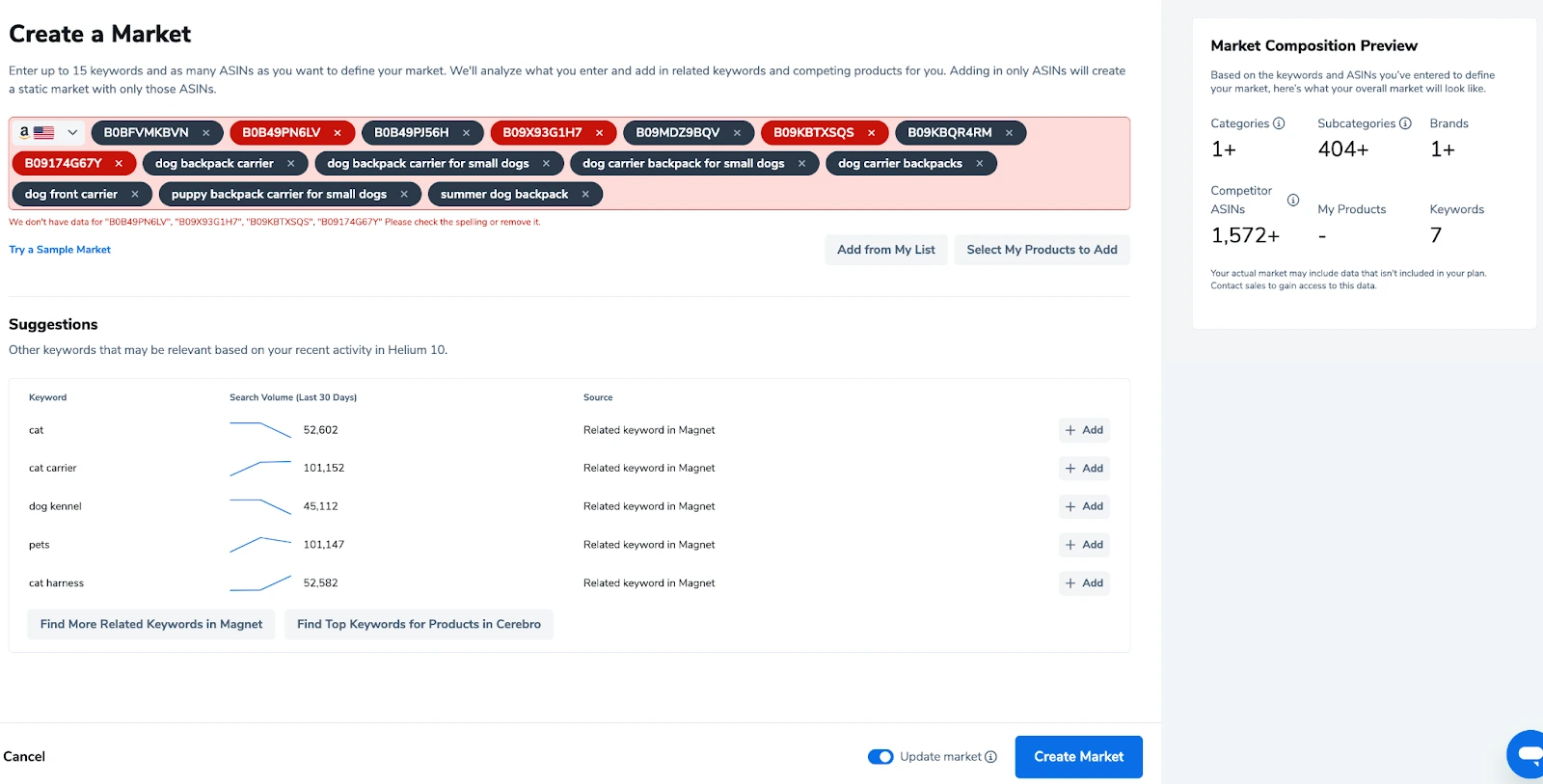

The more I took a look at the products and scoped around Xray and Cerebro, I discovered the market segmented into varying styles for small dogs, medium-sized dogs, and large dogs. Keeping that in mind, I decided to take a handful of keywords that were generating sales for some of these ASINs and a few ASINS themselves to create a market.

The first few small dog-related niche keywords did not end up having enough search volume to be included, but we tweaked it to create a hybrid market.

You can enter up to 15 keywords, and unlimited ASINs to define your market so we used seven related relevant keywords with an assortment of four ASINs of similar styles though there was some variety in color.

Once the market indicator went from Building to Ready, we gained access to the market view.

Market View

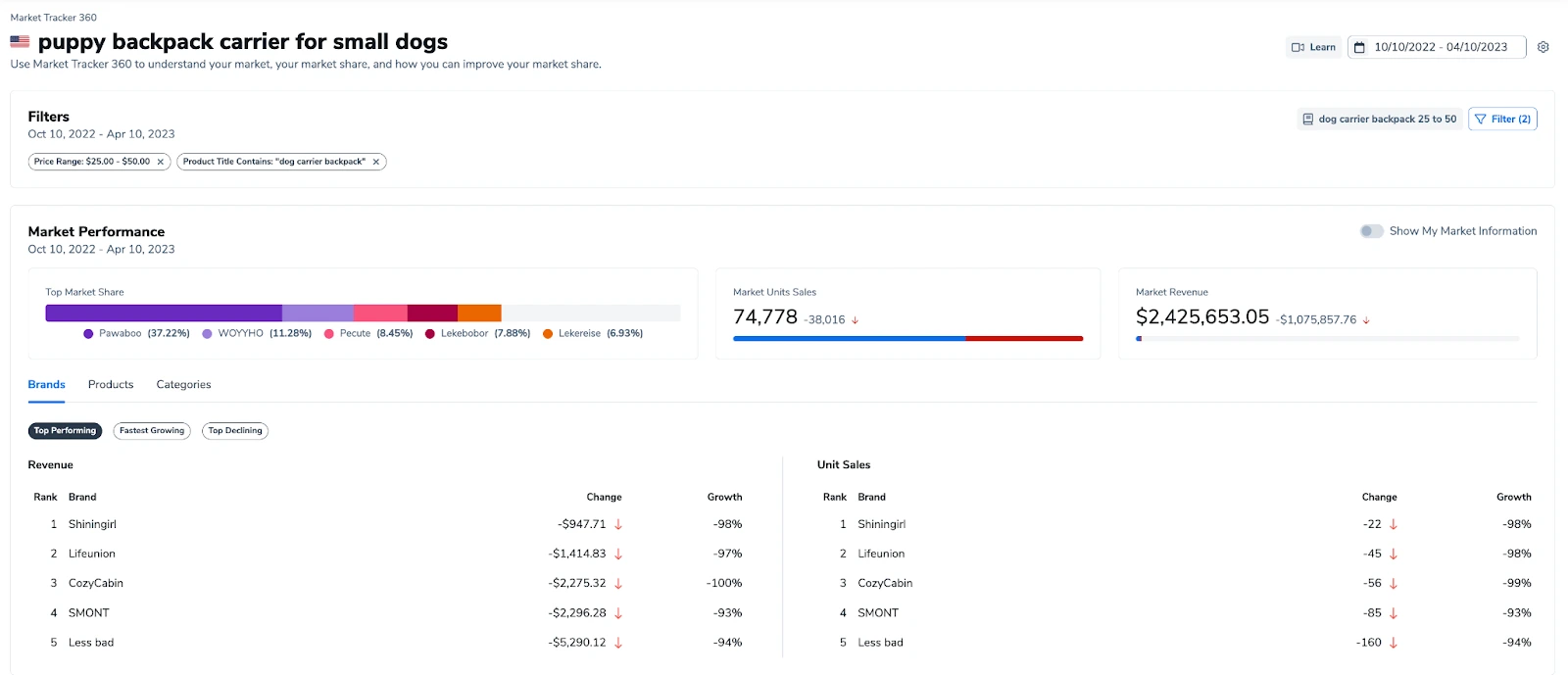

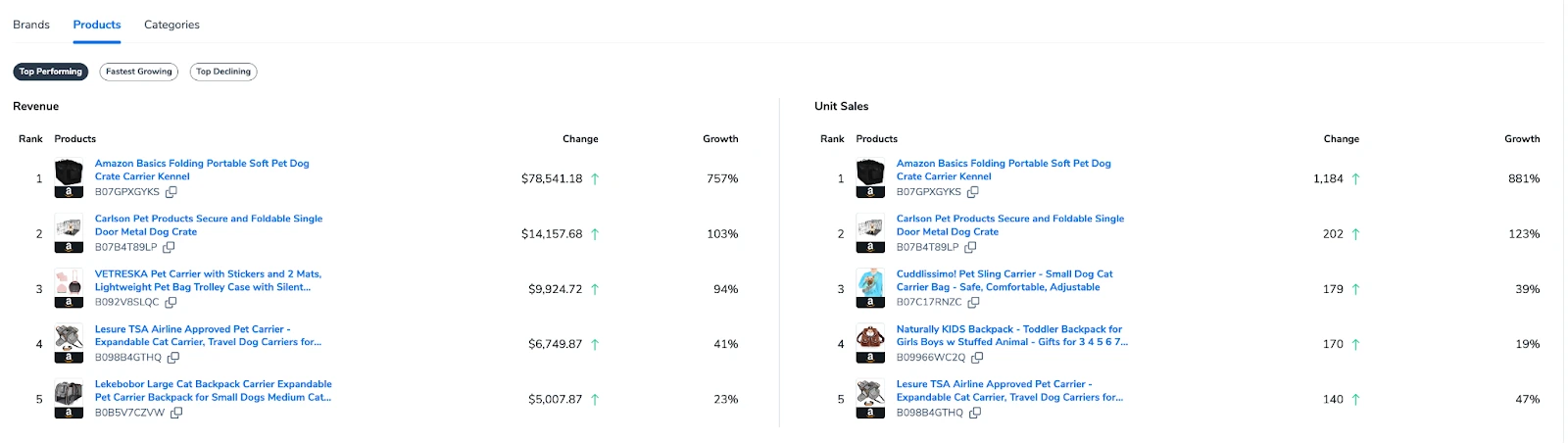

There were no filters applied and in a six-month time frame with no product marked as ‘our own,’ we had a 24.59% market share with a 7% increase from the previous 6 months. The insights board provided a brief overview of which brands and products are top-performing, fastest-growing, and top-declining by revenue and sales. We could extrapolate differences in pricing based on how they stacked up in terms of revenue and sales.

For instance, Active Pets ranked #3 for top-performing brands by revenue but clocked in at position four when audited by unit sales which suggests a higher price point for the brand compared to some of the others in the market. This contrasts with Vceoa which places higher on the insights board for unit sales, but not at all on the revenue implying it may be a lower price tier product.

But these are overarching, high-level conclusions to make. We took a closer look at the data.

Inside the Products tab, not all the products on the insight board are even relevant to the market we wish to acquire information about.

The fifth item is a metal dog crate whereas the second one is a baby infant sling geared towards little humans.

As an aggregator, someone trying to keep up with new competitors entering the market, we would want to refine the search.

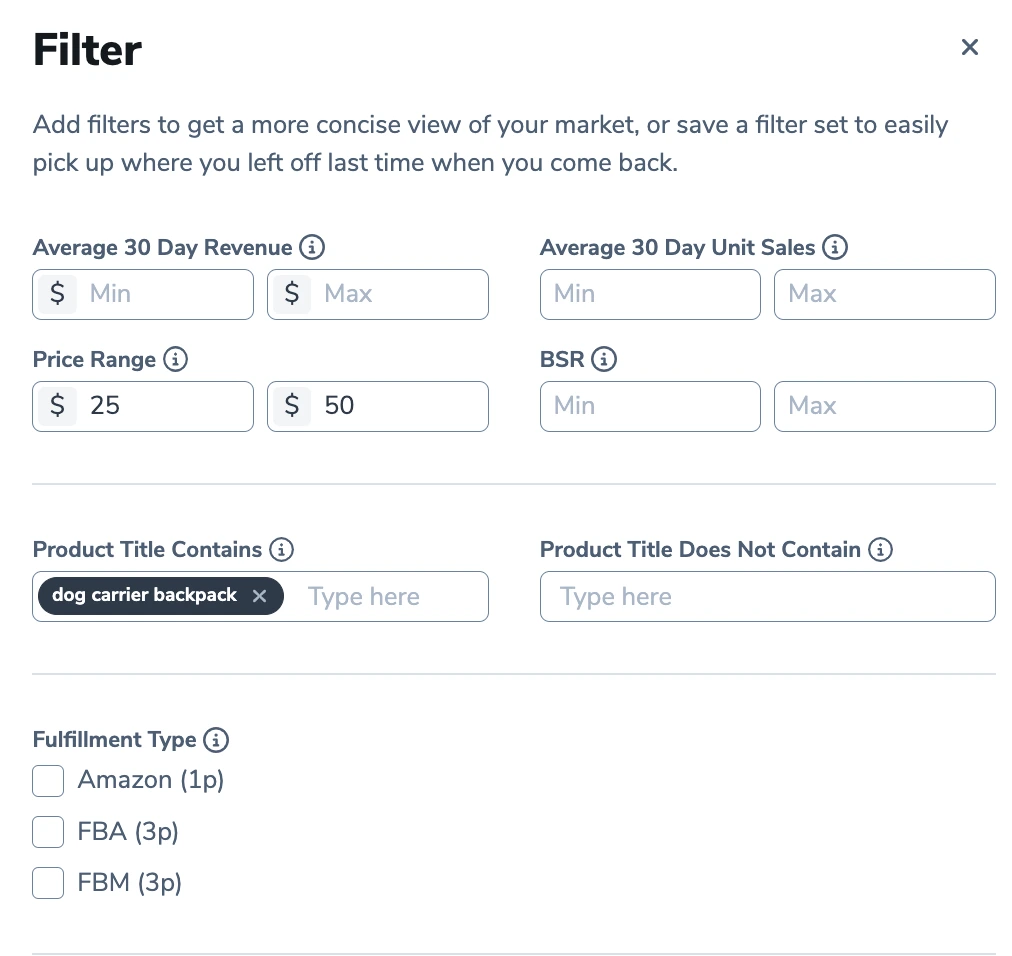

I could easily do that by clicking the gears icon to open up filters, inputting the Product Title containing “dog carrier backpack” and mid-range pricing sitting somewhere in the price range of $25-50.

Administering the two parameters completely changes the outlay of the market pushing different brands, products, and categories to the forefront.

Upon Filtering To Segment Out Our Market of Interest

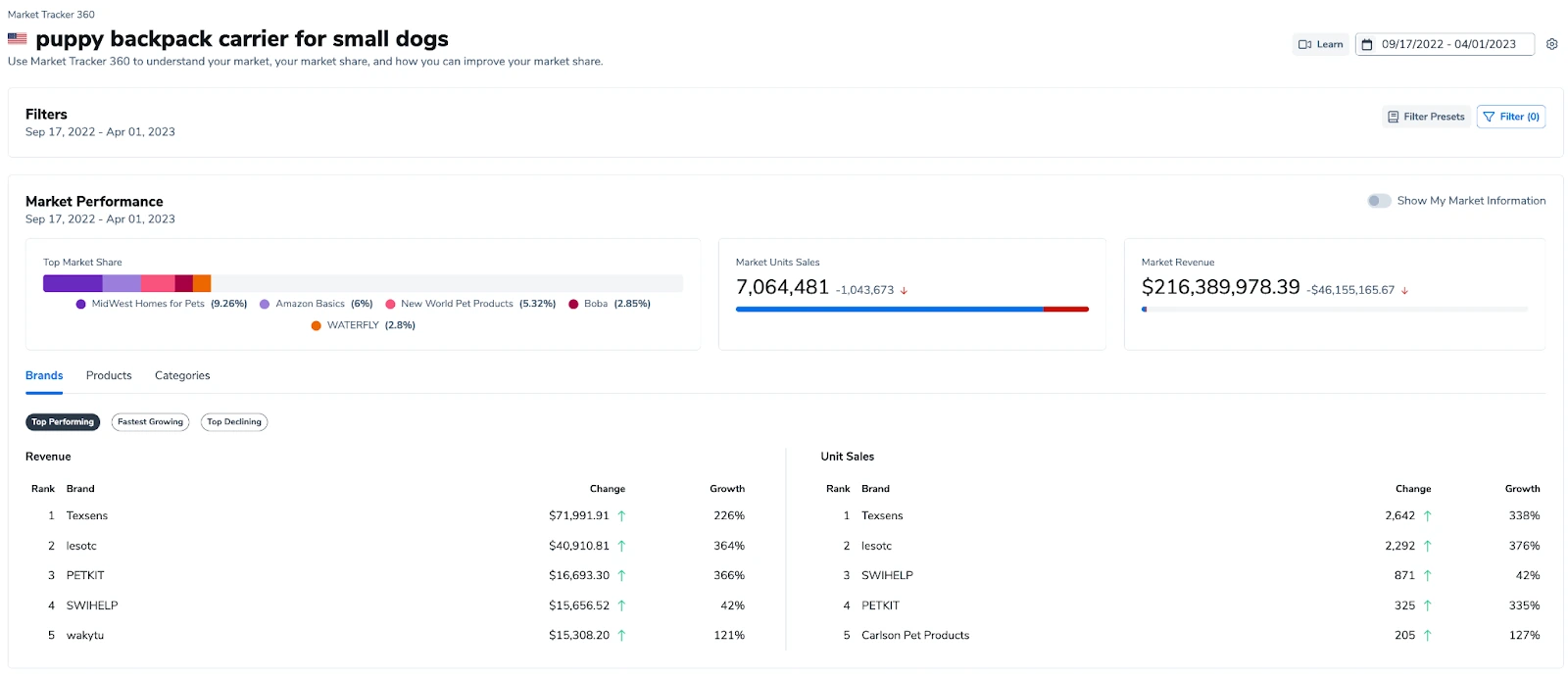

Interestingly, some of the ASINs we inputted jump to the top and the previously 24% market share transitions to a lionshare 74%.

Stacking the Insights Board to the more defined overall market chart, the overall health trendline exhibited when we select revenue grouped by none appears to have grown and steadied out a bit.

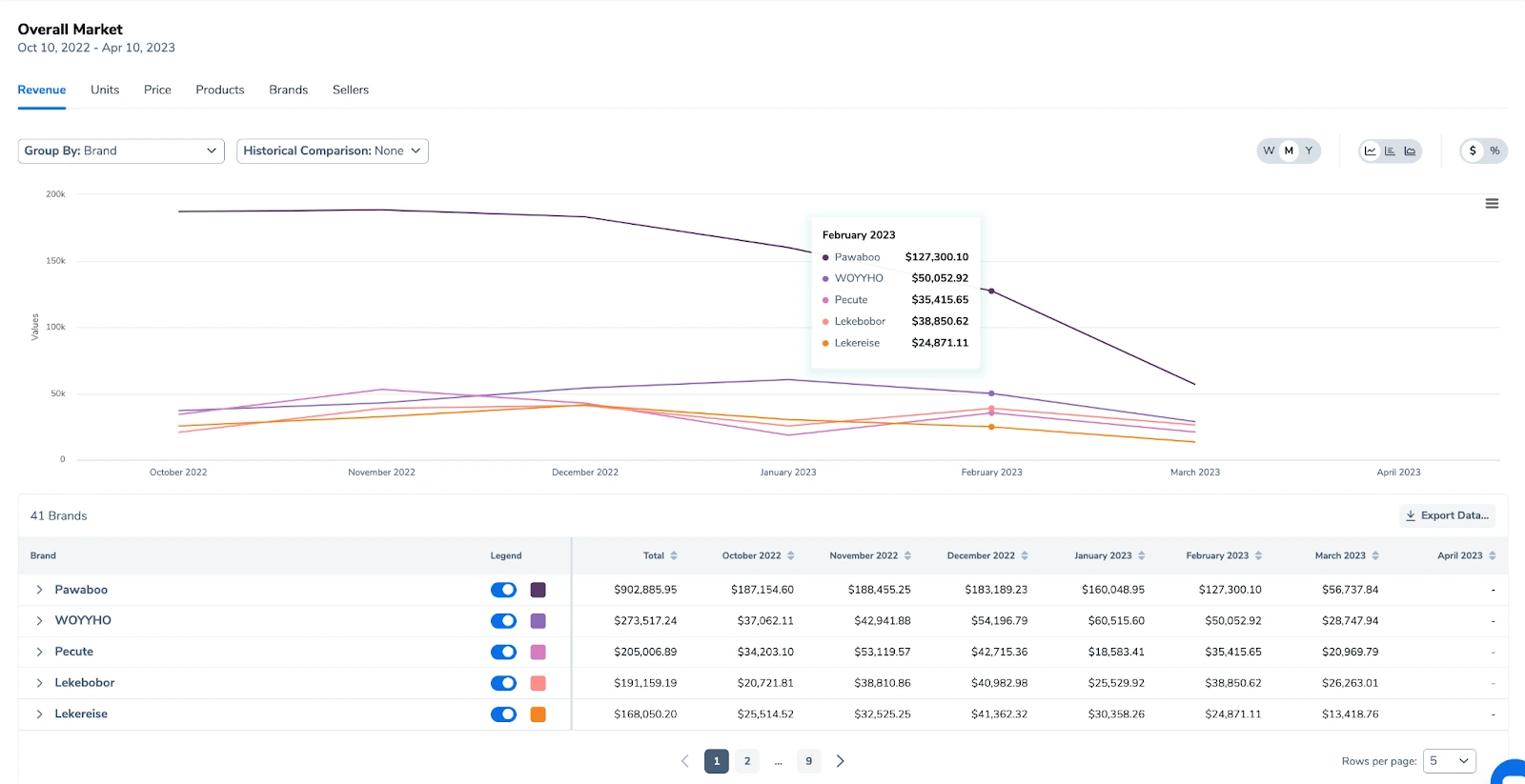

Check out how Pawaboo is doing much larger numbers than the other brands in the niche when grouped by brand with no historical comparisons and in the case we want to see how each brand has done individually, we can take a look at the numbers underneath.

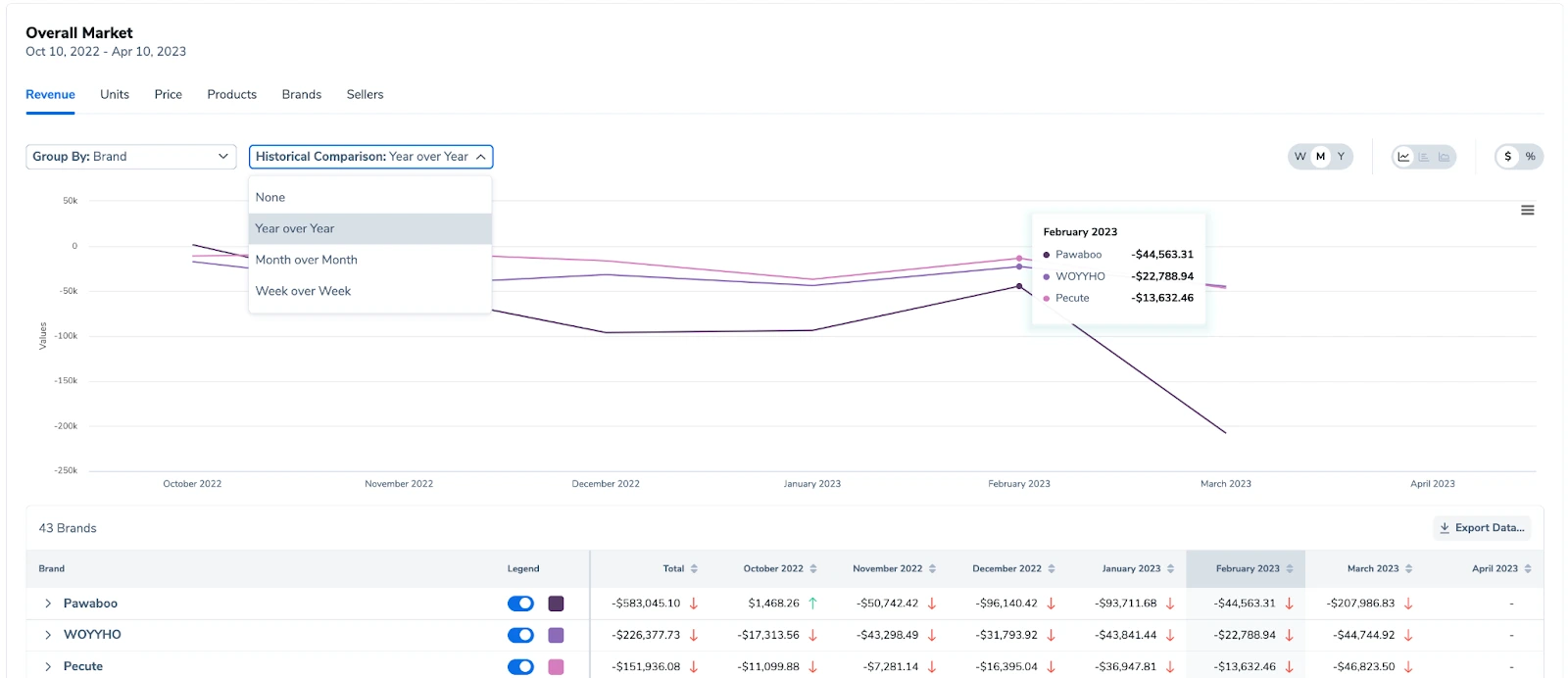

You can also use the drop-down to take a look at historical year-over-year, month-over-month, or week-over-week basis to compare how this year’s metrics stack up to last year’s.

In doing so, you’ll find three of these brands were not doing quite as well compared to the prior period. They are still doing good, but perhaps the demand is not as steady as it once was. As an aggregator or owner of the brand, I would want to understand why that is on a more granular level and question if there is a new customization product on the market capitalizing sales or something else prior to entering or staying in the market.

Now, of course, Market Tracker 360 has a lot more data and insight to provide. But this blog is just to showcase a small fraction of what it can do for you to help you understand all the perspectives you can gain as a scaling seller or aggregator.

Interested in experiencing how multifaceted this tool is firsthand?

Sign up for a demo by visiting here.

We’ll see you there!

Achieve More Results in Less Time

Accelerate the Growth of Your Business, Brand or Agency

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.