Do You Need an LLC to Sell on Amazon?

Table of Contents

- Introduction

- What Is an LLC?

- What Is a Sole Proprietorship

- LLC vs. Sole Proprietorship: Which is Better?

- Benefits of an LLC

- Liability Protection

- Tax Flexibility

- Management Adaptability

- Low Compliance Burden

- Enhanced Credibility

- Additional Amazon Business Entity Types

- S Corporations

- C Corporations

- When to Create an LLC

- Selling High-Risk Products

- When Your Amazon FBA Business Grows Significantly

- How to Form an LLC

- Step 1: Visit Your State's Official Website

- Step 2: Select a Unique LLC Name

- Step 3: Submit Articles of Organization

- Step 4: Obtain an Employer Identification Number (EIN)

- Step 5: Create an Operating Agreement

- Step 6: Secure Necessary Licenses and Permits

- Step 7: Open a Business Bank Account

- Conclusion

Introduction

When learning how to become an Amazon seller, many questions will arise. One of the most common is, “Do I need an LLC to sell on Amazon?”

In order to answer this question, a few concepts need to be covered. What is an LLC? What can it do for you? Do you technically need it to sell on Amazon? What about an LLC for Amazon FBA? How do you set it up, and how much does it all cost?

We’ll cover all of the above questions in this article. Read on to learn more about setting up an LLC for Amazon FBA (both Amazon wholesale and private label), or use the links below to skip any section that interests you.

Outclass Your Competitors

Achieve More Results in Less Time

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.

Sign Up for FreeWhat Is an LLC?

An LLC (Limited Liability Company) is a business structure unique to the United States that provides owners with protection from personal liability. Unlike a sole proprietorship, where the owner and business are legally inseparable, an LLC creates a distinct legal entity. This separation means that if the business incurs debts or faces lawsuits, the LLC itself is responsible, not the individual owners.

One key advantage of LLCs is their flexibility in ownership structure. While sole proprietorships are limited to a single owner, LLCs can have multiple members, allowing for shared ownership and management. This makes LLCs adaptable to various business needs and partnership arrangements.

What Is a Sole Proprietorship

A sole proprietorship is the most basic form of business organization, where a single individual owns and operates the enterprise. This structure comes into existence automatically when an individual begins selling goods or services, without the need for formal registration or incorporation.

The simplicity of a sole proprietorship makes it an attractive option for many entrepreneurs looking to make passive income on Amazon, particularly those starting online businesses. However, it’s crucial to understand that this structure offers no legal distinction between the owner and the business. As a result, the proprietor assumes full personal responsibility for all business obligations, including debts and potential legal actions against the company.

LLC vs. Sole Proprietorship: Which is Better?

The primary distinction between an LLC and a sole proprietorship lies in liability protection. An LLC operates as a separate legal entity from its owners, providing a shield against personal liability. This structure allows the LLC to conduct business independently—such as maintaining bank accounts, incurring debts, and engaging in legal actions.

In contrast, a sole proprietorship offers no separation between the owner and the business. This means the proprietor is personally responsible for all business liabilities, including debts and lawsuits. While business insurance can offer some protection, it doesn’t provide the comprehensive legal separation an LLC does.

Taxation is another consideration. A single-member LLC is typically taxed identically to a sole proprietorship but with added liability protection. This allows for the simplicity of pass-through taxation while safeguarding personal assets.

While establishing a sole proprietorship is effortless—all you have to do is simply start selling— it’s crucial to consider the long-term benefits of forming an LLC. The added protection can be invaluable as your business grows and faces potential risks.

Benefits of an LLC

Establishing an LLC for your Amazon FBA venture provides numerous advantages. This business structure automatically offers legal safeguards, provided you maintain a clear separation between personal and business assets. Among the primary benefits of an LLC are:

Liability Protection

An LLC creates a legal barrier between your personal and business assets. For instance, if a customer is injured by a defective product and sues, only your business assets are at risk, not your personal finances.

Tax Flexibility

LLCs enjoy versatile tax options, allowing them to be taxed as pass-through entities, corporations, or S-corporations (if eligible). This flexibility, unique to LLCs, can be easily elected on annual tax returns.

Management Adaptability

LLCs offer freedom in structuring management. Members can manage collectively, designate specific members, or appoint external managers, allowing for tailored operational control.

Low Compliance Burden

While requirements vary by state, LLCs generally have fewer formalities than corporations. Annual reports and fees are typical, but LLCs avoid the need for boards of directors, shareholder structures, or annual meetings.

Enhanced Credibility

Operating as an LLC can boost your professional image, potentially increasing customer trust and sales. The modest cost of LLC formation often justifies this significant credibility boost.

Note: Remember, to maintain these benefits, it’s crucial to keep personal and business finances strictly separate.

Additional Amazon Business Entity Types

Beyond LLCs and sole proprietorships, Amazon sellers might consider two additional business entity types: S Corporations and C Corporations.

S Corporations

S Corps share tax similarities with LLCs but offer unique advantages. They provide liability protection while avoiding double taxation, as business income flows directly to shareholders’ personal tax returns. However, S Corps face stricter regulations, including limitations on shareholder numbers and eligibility.

C Corporations

C Corps operate as distinct legal entities from their shareholders, allowing for capital generation through stock sales. This structure offers the strongest liability protection but involves higher tax burdens and more complex regulations. C Corps are subject to corporate taxes on profits, and shareholders also pay taxes on received dividends.

When to Create an LLC

You should definitely consider upgrading to an LLC in these scenarios:

Selling High-Risk Products

If your Amazon business deals in potentially hazardous items like supplements or electronics, forming an LLC is advisable. These products carry a higher risk of customer harm, potentially leading to lawsuits or liability claims.

For example, if you sell electronic devices and a customer suffers an injury due to a malfunctioning product, an LLC structure would protect your personal assets from potential legal action. In this scenario, only the business assets would be vulnerable to claims, ensuring your personal finances remain secure. This separation of personal and business liability is crucial when dealing with products that have a higher risk of causing harm or sparking consumer disputes.

When Your Amazon FBA Business Grows Significantly

As your business expands, so do associated risks. Growth often involves hiring employees, which can lead to potential workplace disputes or lawsuits. Expanding product lines or entering new markets may also bring additional regulatory and compliance requirements.

Furthermore, LLC owners can opt for S Corporation tax status, potentially offering more tax advantages. This allows owners to split their income between salary (subject to payroll taxes) and distributions (exempt from payroll taxes). This strategy can result in substantial tax savings, as payroll taxes typically exceed income tax rates.

How to Form an LLC

Creating an LLC for your Amazon FBA business can be accomplished in seven straightforward steps, as outlined in our comprehensive LLC formation guide. The process primarily involves submitting the appropriate forms to the relevant state agency (typically the secretary of state’s office) and paying the required filing fees.

While it’s feasible to set up an LLC independently, especially for an e-commerce venture, you may opt to use formation services like ZenBusiness or LegalZoom to streamline the process and ensure accuracy.

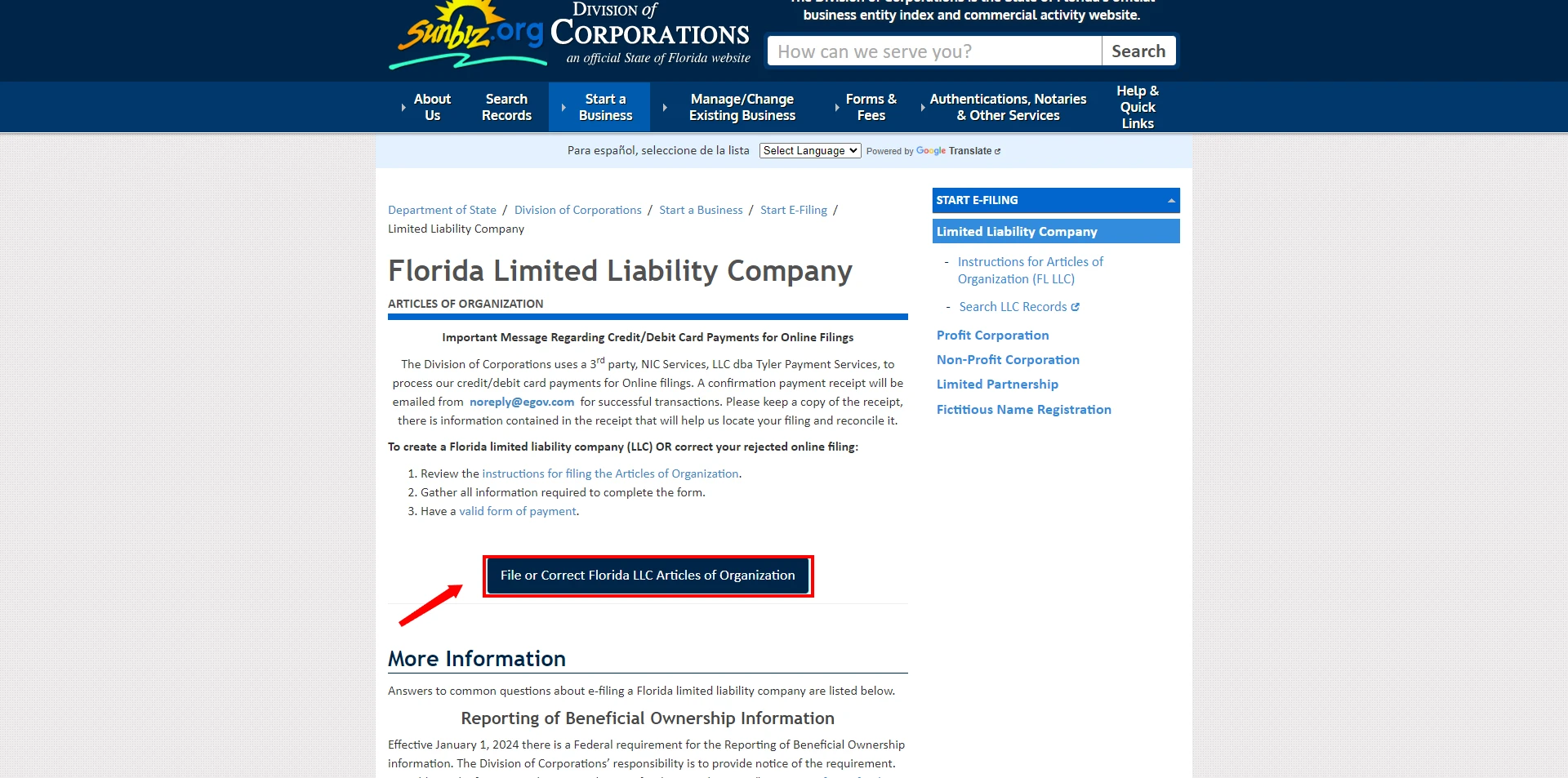

Step 1: Visit Your State’s Official Website

Each state has unique LLC formation requirements. Search for “[Your State] LLC registration” on Google to find the official state website. For instance, if you’re based in Florida, search for “register Florida LLC.”

Then, navigate to the business registration section on your state’s site. You’ll likely need to create an account before initiating the LLC formation process.

Step 2: Select a Unique LLC Name

Choose a distinctive name for your LLC that isn’t already in use by another business in your state. Most secretary of state websites offer a name availability search tool to verify your chosen name’s uniqueness.

Step 3: Submit Articles of Organization

This crucial document legally establishes your LLC. File it with your state’s secretary of state office, along with the required fee. Typical information needed includes:

- LLC Name

- Registered Agent Details

- Business Purpose

- Member Names

Step 4: Obtain an Employer Identification Number (EIN)

An EIN is a unique identifier for your business, similar to a Social Security Number for individuals. This tax ID is essential for opening a business bank account, filing taxes, and hiring employees. You can easily apply for an EIN online at no cost through the IRS website.

Step 5: Create an Operating Agreement

While not legally required in all states, drafting an operating agreement is highly recommended. This document outlines your LLC’s management structure, member roles, responsibilities, and voting rights. It provides clarity and can prevent potential disputes among members.

Step 6: Secure Necessary Licenses and Permits

The specific licenses and permits required vary based on your business type and location. Common examples include business licenses, sales tax permits, zoning permits, health department permits, and professional licenses. Research your local and state requirements to ensure compliance.

Step 7: Open a Business Bank Account

Establishing a separate bank account for your LLC is crucial for maintaining the legal separation between personal and business finances. This separation is vital for liability protection and simplifies tax reporting. It also streamlines bookkeeping by keeping all business transactions in one place.

Conclusion

While deciding whether or not to form an LLC to sell on Amazon or utilize Amazon FBA is a personal business owner’s decision, there are a lot of tools out there to help Amazon sellers succeed.

At Helium 10, we offer an all-in-one software solution for Amazon sellers. Whether you need to survey the marketplace, conduct keyword research, track inventory, or analyze key analytics, our platform can help you meet all of your business goals when selling on Amazon. To learn more about our platform, services, and resources, contact us directly on our website or chat with a support specialist.

Frequently Asked Questions

Achieve More Results in Less Time

Accelerate the Growth of Your Business, Brand or Agency

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.